tax shield formula dcf

How the DCF Works Overview Based off any available financial data both historical and projected the DCF First projects the Companys expected cash flow each year for a finite. However here in FCF formula we dont account the Tax.

This is not done for.

. The formula includes that comes from. Lets get back to our scenario 1. Tax Shield Tax Rate x Value.

Tax Shield Value of Tax-Deductible Expense x Tax Rate So for instance if you have 1000 in. Further I can show a general expression for tax shields implementation wherein this well known WACC formula is only a special case. It is multiplied by 1 T.

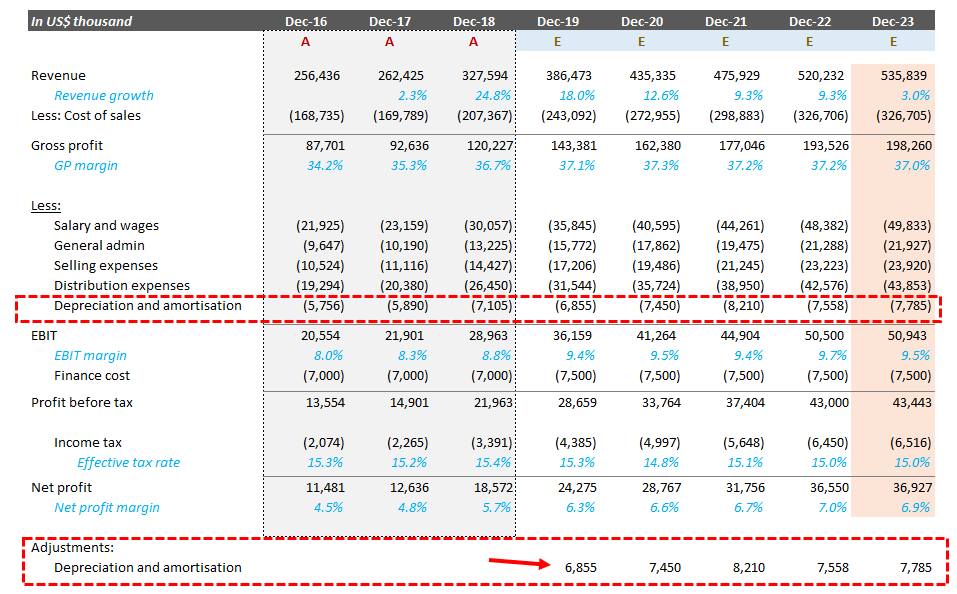

This formula is called the. Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense can be manually calculated by subtracting the salvage value ie. At last a terminal value is most often calculated as a perpetuity.

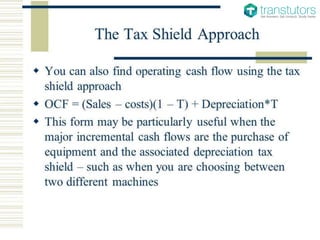

Since interest payments are tax-deductible the cost of debt needs to be multiplied by 1 tax rate which is referred to as the value of the tax shield. Its 50000 debt load has an interest tax shield of 15000 or 50000 30 7 7. FCF EBIT 1-Tc Depr.

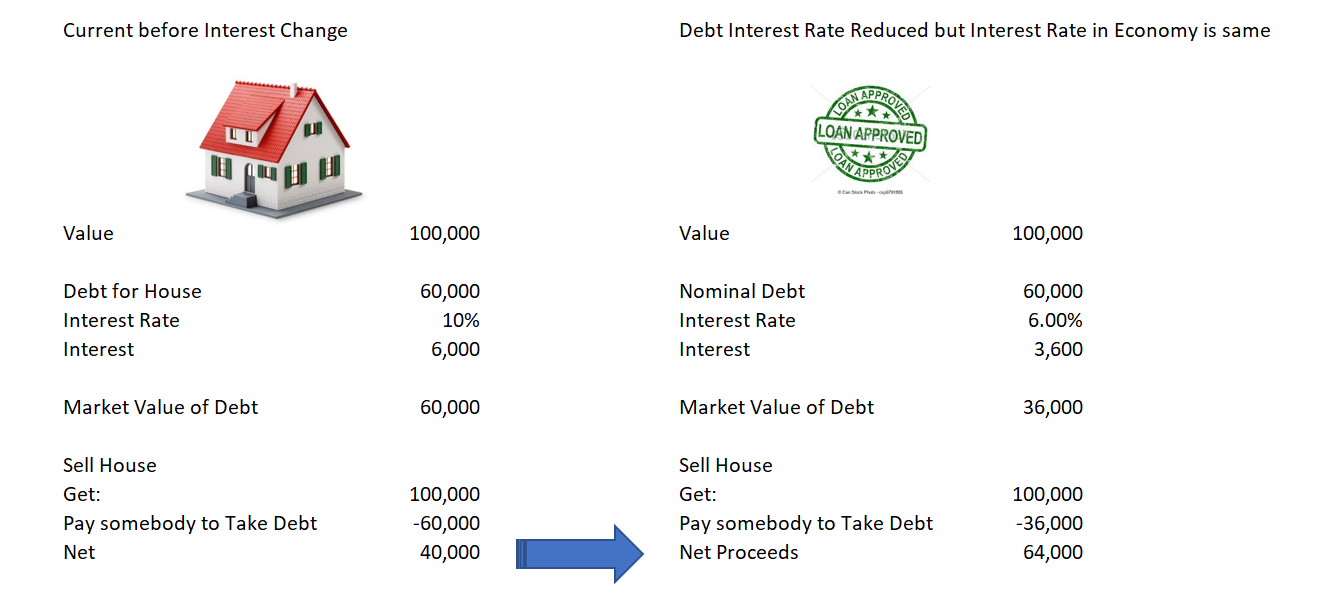

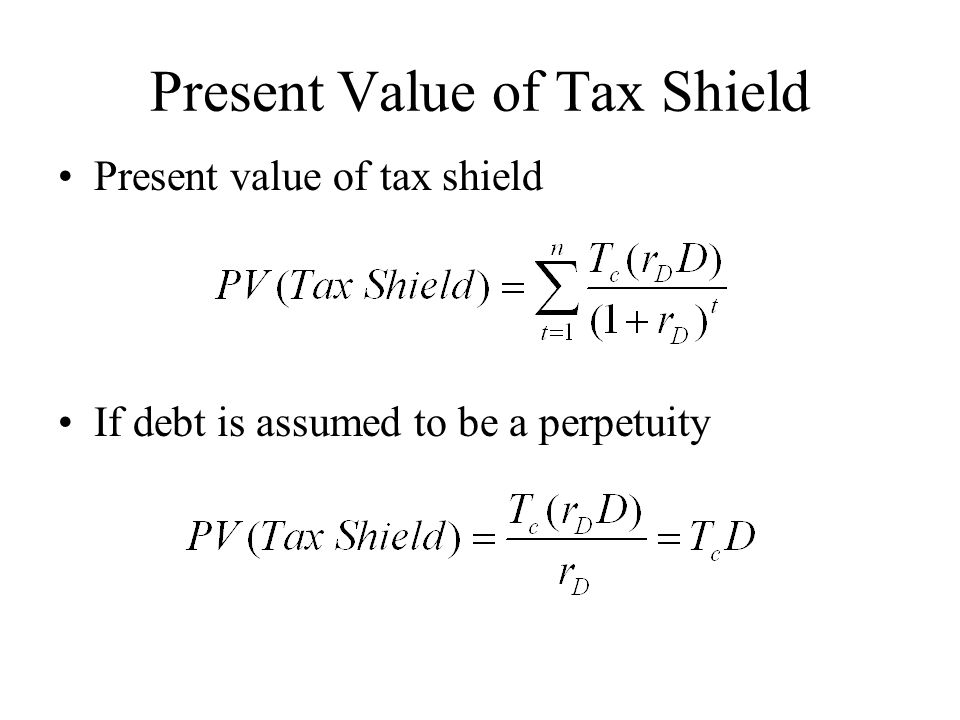

Suppose the market value of debt in the capital structure in this scenario is 1000. This is calculated as the annual free cash flow at the end. The formula for calculating Present Value PV is as follows.

Interest Tax Shield Interest Expense Tax Rate For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k. Assuming the debt is recent this gives us a pre-tax cost of. This is to acknowledge the fact that Interest Expense on.

Discounted Cash Flow DCF Overview. Calculating the tax shield can be simplified by using this formula. It is utilized to boost cash flows and further raise a companys worth by decreasing tax expenses.

Harris Pringle Beta Formula. - Capex - WC My understanding is that interest expense impacts the tax amount. The tax rate for the company is 30 and the interest rate is 7.

Utilizing the following formula will make the calculation easier.

Discounted Cash Flow Dcf Valuation Investment Guide

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Using Apv A Better Tool For Valuing Operations

Pdf A Simple Approach To Valuing A Multinational Firm S Tax Shields

How Much Should A Firm Borrow Ppt Video Online Download

Training Modular Financial Modeling Ii Dcf Valuations Enterprise Dcf Valuation Overview Modano

Using Apv A Better Tool For Valuing Operations

Present Value Of Tax Shield On Cca Evaluation And Computations In Corporate Finance Lecture Slides Slides Corporate Finance Docsity

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Training Modular Financial Modeling Ii Dcf Valuations Enterprise Dcf Valuation Overview Modano

Discounted Cash Flow Dcf Valuation Investment Guide

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example